- IPC stands for ‘Charities with Institutions of Public Character (IPC)’.

- An IPC is an organisation approved by the Commissioner of Charities to receive tax deductible donations. This means donors are given tax deduction for donations made to these organizations.

- Not all charities have IPC status. For information on registered IPCs, please visit the Charity Portal https://www.charities.gov.sg.

- To encourage Singaporeans to support a charitable cause, you can enjoy a 250% tax deduction during the next tax season if you donate to an IPC before the year ends.

How does this tax deduction thing work?

Firstly,

Assessable Income = Total Income – Donations x 2.5

Eg. Your total yearly income is $100,000. For the $10,000 donation, the tax deduction that you enjoy is: 2.5 x $10,000 = $25,000.

The Assessable Income

= Total Yearly Income – Tax Deduction

= 100,000 – $25,000 = $$75,000

You have to submit your NRIC/ FIN No/ UEN to the IPC at the point of donation if you want tax deductions.

Also, only donations without any material benefit to the donor will be fully tax deductible.

Eligible donations will then have the tax automatically deducted from your tax payable in the following year.

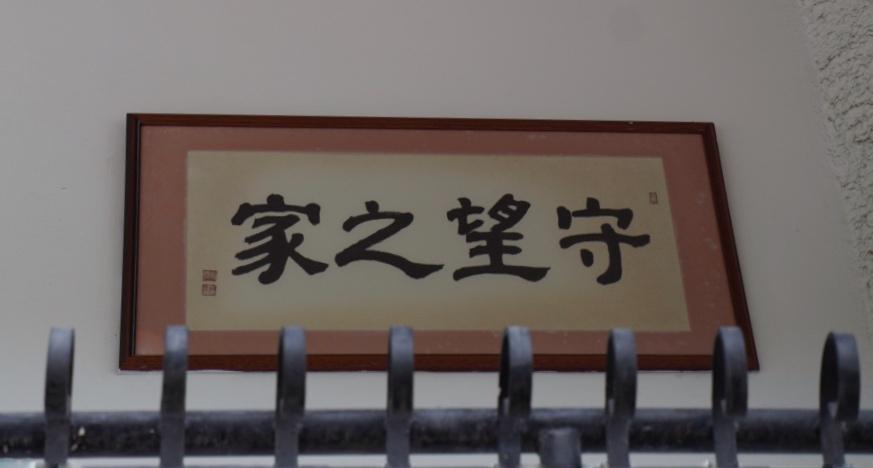

- To retrieve Annual Report/ Financial Information on ‘Watchman’s Home Community Services Ltd’, click on the following link to access the charity Portal and login using your own SingPass:

- Other Links